Options Trading in Forex

Contents

Foreign exchange options are a relative unknown in the retail currency world. Although some brokers offer this alternative to spot trading, most don’t. The holder of a call option has the right to purchase the underlying asset at a specified strike price on or before expiration. A call option is a bullish position that profits when the cost of the underlying increases. A contract that grants the holder the right, but not the obligation, to buy or sell currency at a specified exchange rate during a particular period of time.

The forex market is the largest financial security market worldwide, with a daily total dollar value of trading averaging over $6.5 trillion. The total value of the entire forex market is estimated at more than $2 quadrillion. Extrinsic value is also affected by the volatility of the underlying stock. American options can be exercised anytime on or before the date of expiration.

Options trading is when you buy/ sell an options contract on a recognized stock exchange with the help of the online trading platform provided by your stockbroker. It’s possible to see those fluctuations through forex trading, where essentially you have to try and predict how one currency will move relative to another. This might sound impossible, but there are a number of factors involved and it’s possible to correctly predict forex movements through intensive research and analysis.

Options traded in the Forex market differ from those traded in other markets in that they allow traders to trade without physical delivery of the asset. Forex options traders can select prices and expiration dates that are appropriate for their hedging or active trading strategy. Unlike futures traders, who must fulfill the terms of the contract at expiration, options traders do not have that obligation but only the right to deal with a certain asset. CFDs options use underlying instrument factors such as the it’s market price and strike price. They are also influenced by market movements similar to traditional options.

However, this could result in unlimited losses if the pair doesn’t move in your favour. The next logical questions would Forex pairs would be the best to trade? This is because these pairs come from big countries with a good and stable economy.

Forex options trading example

In all FX transactions, one purchases a currency for another one. Therefore, every single currency pair trades both as a Call and Put. The purchaser of an FX Call Option has the right to buy the underlying currency. The seller of the Call option has an obligation to sell the underlying currency if the purchaser exercises his right. An FX Put Option gives the purchaser the right to sell the underlying currency. The seller of the Put Option must sell the underlying currency if the purchaser exercises his right.

- You can increase your odds of being a successful options trader by trading options on stocks you’re already familiar with.

- A pip is the smallest price increment tabulated by currency markets to establish the price of a currency pair.

- Now traders can simply pay the spread to enter the market, commission-free.

- The price of a Forex Option tries to represent the measure of risk.

- It should be made clear that options trading is a much more complicated subject than stock trading and the whole concept of what is involved can seem very daunting to beginners.

Structuring trades in currency options is actually very similar to doing so in equity options. Putting aside complicated models and math, let’s take a look at some basic FX option setups that are used by both novice and experienced traders. A spread position is one where you are both the buyer and the writer of the same type of option, although strike price and expiry dates can be different. Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period.

It is very important that the strike price and expiration are the same. If they are different, this could increase the cost of the trade and decrease the likelihood of a profitable setup. Joey Shadeck is the Content Strategist and Research Analyst for ForexBrokers.com. He holds dual degrees in Finance and Marketing from Oakland University, and has been an active trader and investor for close to ten years. An industry veteran, Joey obtains and verifies data, conducts research, and analyzes and validates our content. Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm.

IQ Option

This would lead them to buy a forex option in anticipation of profit at the agreement expiration. If you want to use a currency trading system built around options selling, keep the two points below firmly in mind to get the odds even more on your side. On the contrary, the option seller risks are prospectively endless, making the profit to be restricted to the premium obtained. Finally, limitless losses are incurred when the currency pair moves in the opposite direction, not favoring the merchant. Additionally, buying of this financial instrument is done when there is a forecast of the currency prices movement upward, thus making profits off of the agreement.

Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice. Almost all forex options are cash-settled, where no delivery takes place. Thus, it can be convenient to trade these financial instruments in the same way investors trade non-deliverable spot forex (i.e., CFD trading). The holder of a put option has the right to sell the underlying asset at a specified strike price on or before expiration. A put option is a bearish position that profits when the cost of the underlying decreases. Let’s say aninvestor is bullishon the euro and believes it will increase against the U.S. dollar.

In addition you can have a look at the list of the best options trading courses and best forex trading courses. However, if you’re willing to take on more risk in exchange for the potential for higher rewards, options trading may be the better choice. If the FX rate moves against our position in the FX spot market, we have a loss. By acquiring a Forex Option, we can remove the risks of unpredictable losses; our minus will always be limited to the Premium then.

A call option is a contract that gives the option buyer the right to buy an underlying asset at a specified price within a specific time period. You can use options trading as a means to diversify your trading portfolio. But you need to have a clear strategy before you trade and have a disciplined approach while trading.

ETX Capital

These types of transactions are very common among multinational corporations that hedge their currency exposure. They are also utilised by forex traders who often take up positions in response to ongoing world events. A wide variety of strategies that can be explored, such as hedging, spreads, straddles, butterflies, and strangles can be explored through options or futures. These will often involve high and low yield cross currency pairs and attempt to profit from by shorting low yield currencies.

They involve the currencies euro, US dollar, Japanese yen, pound sterling, Australian dollar, Canadian dollar, and the Swiss franc. When an option is exercised, the cost to the buyer of the asset acquired is the strike price plus the premium, if any. When the option expiration date passes https://1investing.in/ without the option being exercised, then the option expires and the buyer would forfeit the premium to the seller. In any case, the premium is income to the seller, and normally a capital loss to the buyer. Between 72-89% of retail investor accounts lose money when trading CFDs.

An FX option – which can be a call or a put, is used to set an exchange rate for a future transaction in order to protect against unfavourable currency movements. Options contracts are comparable to both futures and forward trading, except that once you’ve put them together, you’re committed to seeing them through to the end. A call option allows you to buy, while a put option allows you to sell.

What is forex options?

Forex options and their Contracts for Difference are popular among traders for a variety of reasons. Firstly, they have a limited downside risk because they can only lose the premium they paid to purchase the options, but they have unlimited upside potential. For someone buying options, the risk is usually controlled by the cost of purchasing isin code the option. In theory, the potential for making profits for someone trading in forex options has no limits. For the prevention of prospective losses in the FX market, every option agreement usually has an expiry date. Therefore, if the currency pair fails to hit the goal price, one can wait until the contract expires to keep the premium.

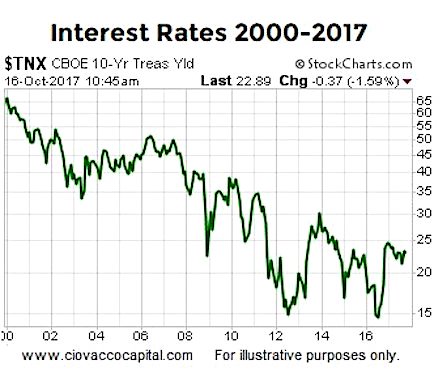

Higher implied volatility increases the price of the Forex Option because there is an increased chance for profitable movements. Calculating the time value even addresses the difference in the interest rates between the two currencies. Such embedded interest rate differentials in currency trades are called FX swap rates. We can understand FX Options as commitments; to future transactions in forward contracts and for predetermined prices. What is important is that the buyer of an FX Option has no obligation to exercise his right.

#4. Allocate 2% to 5% for a Single Trade

Some options brokers charge fees for setting up options and some are paid every time they conduct a trade on behalf of clients. Operating since 1999, FOREX.com was a first mover in bringing currency markets to the retail trader. ETX Capital broker provides Forex, Spread betting and CFD trading options for all types of investors – from tools and education to trading. Fxpro Forex Broker Founded in 2006, London-based FXPro is an online broker offering Forex trading along with Options. The MT4, MetaTrader5 and cTrader online trading platforms are available. There are several key differences between forex vs options trading.

For example, an exporter of mangoes in India will buy a USDINR put option to hedge against the decreasing rate of INR per 1 USD. The exporter does this to protect himself from the appreciation in the value of INR, so as to stop it from eating into his profit. For example, an importer of oil in India will buy a USDINR call option to hedge against the increasing rate of INR per 1 USD. The importer does this to protect himself from the depreciation in the value of INR, so as to stop it from eating into his profit. FX is the most liquid market in the world, with unlimited trading opportunities around the clock. Combines crude oil benchmarks into a single index that reduces exposure to specific geopolitics and fundamental influences, representing a greater world of oil markets.

All of Banxo’s trades are conducted through a third-party Liquidity provider, and the Liquidity Provider is the sole Execution Venue for the execution of Client Orders. Trading Forex is an accessible way to get into online trading quickly and easily. This will ensure that you have cash flows from more number of winning trades. To square off the trade, you need to select the box “the blue tick” symbol appears when the instrument gets selected. Click on the market depth tab and you will get the live BID and ASK quotes and the trade details.

74% of retail client accounts lose money when trading CFDs, with this investment provider. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.